- Average Copay For Doctor Visits In America

- Average Copay For Doctor Visit For A

- Average Copay For Doctor Visit Vs

- Help Paying Doctor Copays

- Average Copay For Office Visit

Last Updated : 10/06/20185 min read

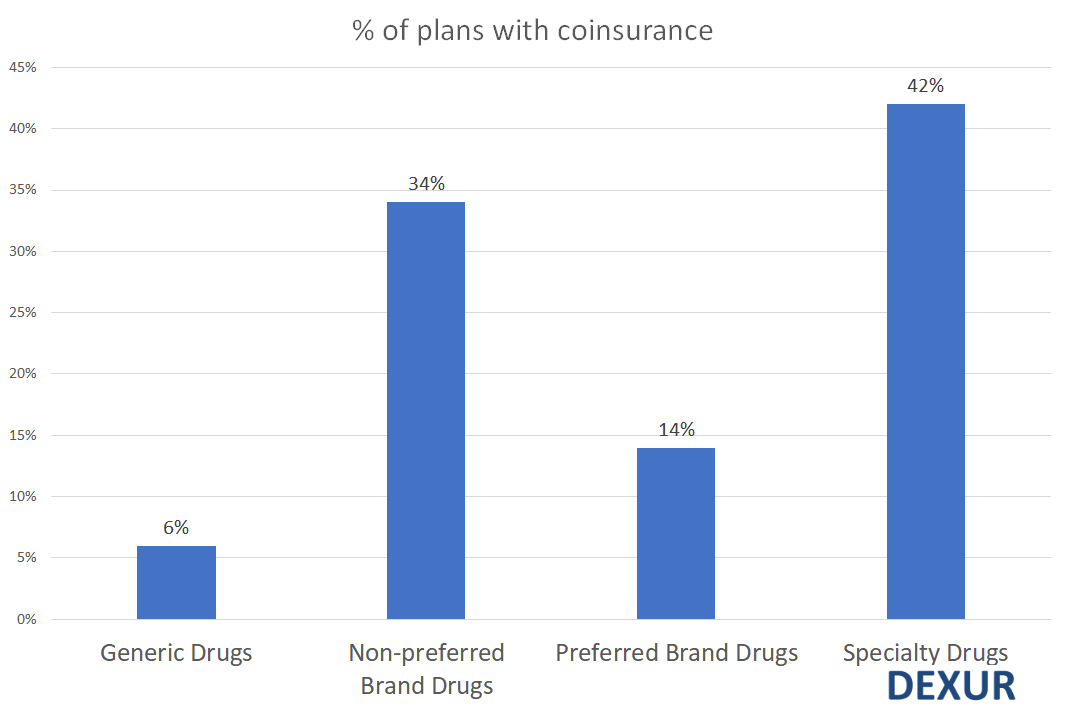

Copay amount for first 3 visits in each calendar year. If related to a condition that's covered by a special authority.: $0 (no copay) If not related to a condition covered by a special authority.: $30 each visit. Copay amount for each additional visit in the same year. Medicare Part B: Doctor Costs and Lab Tests. Medicare Part B pays for outpatient medical care, such as doctor visits, some. But if you have a higher than average. A typical copay for a routine visit to a doctor’s office, in network, ranges from $15 to $25; for a specialist, $30-$50; for urgent care, $75-100; and for treatment in an emergency room, $200-$300. Copays for prescription drugs depend on the medication and whether it is a brand-name drug or a generic version.

If you’re on Medicare, you might expect that the program would cover doctor visit costs. Medicare may cover doctor visits if certain conditions are met, but in many cases you’ll have out-of-pocket costs, like deductibles and coinsurance amounts.

Find affordable Medicare plans in your area

Doctor visits: a general rule

No matter what kind of Medicare coverage you may have, it’s important to understand that your doctor must accept Medicare assignment. That’s an agreement the doctor has with Medicare that the doctor will accept the Medicare-approved amount as payment in full for a given service, and won’t charge you more than a coinsurance payment and deductible.

Doctor visits: How does Original Medicare cover them?

Suppose a patient has a health insurance plan with a $30 copay to visit a primary care physician, a $50 copay to see a specialist, and a $10 copay for generic drugs. Inpatient mental health care in a psychiatric hospital is limited to 190 days in a lifetime. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital. Find out who to call about Medicare options, claims and more.

Original Medicare is made up of Part A (hospital insurance) and Part B (medical insurance). Generally, Part B covers doctor visits – even when you’re in the hospital, where a lot of your care comes under Part A. A deductible and/or coinsurance amount may apply.

Many services covered under Part B come with a 20% coinsurance amount after you’ve paid your Part B deductible. For example, if the Medicare-approved amount for a doctor visit is $100, and you’ve already paid your Part B deductible, you’d pay $20 in coinsurance (20% of $100). If the doctor orders tests, those may be extra.

Did you know you might be able to buy insurance that may cover these out-of-pocket costs for doctor visits? Read about Medicare Supplement (Medigap) insurance plans below.

Doctor visits and Medicare Supplement insurance

It may be useful to know that Medicare Supplement insurance plans may help pay for Medicare Part A and Part B out-of-pocket costs. Medicare Supplement insurance plans generally pay at least part of your coinsurance amounts for Medicare-covered doctor visits. Most standardized plans typically pay the full Part B coinsurance amount.

For example, suppose you had a doctor visit, and the doctor ordered an MRI (magnetic resonance imaging) screening. Let’s say the Medicare-approved costs were $100 for the doctor visit and $900 for the MRI. Assuming that you’ve paid your Part B deductible, and that Part B covered 80% of these services, you’d still be left with some costs. In this scenario, you’d typically pay $20 for the doctor visit and $180 for the x-rays.

If you had Medicare Supplement Plan M, those Part B out-of-pocket costs might be completely covered so you would pay nothing. Of course, Medicare Supplement plans come with a monthly premium. But if you have many doctor visit costs, you might want to learn more about Medicare Supplement plans.

Average Copay For Doctor Visits In America

Some doctor visits may be free of charge

Average Copay For Doctor Visit For A

If you have Medicare Part B, or if you’re enrolled in a Medicare Advantage plan, you may get a number of doctor visits and screenings free of charge.

- “Welcome to Medicare” preventive care visit. During the first 12 months after you enroll in Medicare Part B, Medicare provides full coverage for this preventive care doctor visit. The “Welcome to Medicare” doctor visit may include:

- A review of your medical history

- A simple vision test

- Certain disease prevention/detection screenings

- A depression screening

- Certain shots if needed

- Measurement of your vital signs (such as height, weight, and blood pressure)

- A written plan outlining what additional screenings, shots and other preventive services you need.

- Annual wellness visit. After the first 12 months of coverage, Medicare covers a wellness doctor visit once a year. The doctor will review your medical history; update your list of medications; measure your height, weight, blood pressure and other vital signs; and discuss your health status with you.

Medicare Part B may cover other doctor visits and preventive screenings. For example, you’ll get a doctor visit every year to evaluate and help reduce your risk of cardiovascular disease. There is no charge for this visit.

Be aware that if your doctor orders other tests or medical services during your doctor visit, you might need to pay a deductible amount or coinsurance. Medicare might not cover certain tests or services at all. You might want to find out ahead of time whether the services are covered.

Average Copay For Doctor Visit Vs

Doctor visits and Medicare Advantage

Perhaps you chose to enroll in a Medicare Advantage plan as an alternate way to receive your Original Medicare benefits. Your doctor visits may have different out-of-pocket costs than you’d pay under Original Medicare.

Medicare Advantage plans are offered by private insurance companies contracted with Medicare. Some plans have monthly premiums as low as $0, but they generally have other costs. Coinsurance, copayments, and deductibles may vary from plan to plan – as will premiums.

Help Paying Doctor Copays

You’ll still have to pay your Medicare Part B premium if you sign up for a Medicare Advantage plan – in addition to any premium the plan may charge.

Are you looking for more information about Medicare coverage and doctor visits? Would you like to learn more about your Medicare coverage options? Please feel free to contact me by using the links below. If you wish to compare some of the Medicare plans where you live, use the Compare Plans button on this page.

Average Copay For Office Visit

Benefits, premiums and/or copayments/co-insurance may change on January 1 of each year.