Days 1 – 20: $ zero co pay for each benefit period Days 21 - 100: patient pays $185.50 coinsurance per day during 2021 Days 101 and beyond: patient pays all costs. Do you know your rights to nursing home coverage under Medicare? Annual copay caps on drugs dispensed by the pharmacy. $250 per calendar year on drugs dispensed by pharmacies. New member exclusions will apply. Please note, acute inpatient hospital copays have been eliminated as of 03/18/20. Monthly copay caps on drugs dispensed by the pharmacy. Members will be assigned a copay cap not to exceed 2% of family.

- Masshealth Drug Coverage List

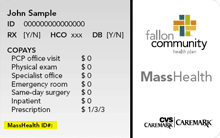

- Masshealth Copays

- Masshealth Copay Assistance

- Masshealth Copays

- Masshealth Copayment

Medicaid is both a federal and state-based program. In the state of Massachusetts, the Medicaid program is called “MassHealth.” MassHealth beneficiaries have access to low-cost hospital services, doctor visits, prescription drugs, and more. After reading through our guide, reach out to us with any questions or concerns you might have. We specialize in Medicare but may be able to help you with other health benefits in the state of Massachusetts.

Click below to learn more about Massachusetts Medicaid:

MassHealth Benefits

All Medicaid programs are required to cover the same set of benefits, but each state has the ability to add more benefits according to its resident’s needs. The MassHealth program covers hospital services, doctor services, prescription drugs, mental health, substance abuse, and so much more.

What’s on the Drug List and Formulary?

MassHealth covers prescription drugs, always starting with generics. Some brand-name drugs may be covered, but your doctor will have to submit a “prior authorization” form with proof that you need the brand-name drug before MassHealth will cover it. Most MassHealth beneficiaries will have to pay a small copayment (usually between $1 and $4) for prescription drugs. Click here for the MassHealth formulary.

If you have both Medicare and Medicaid, your prescription coverage will come from your Medicare benefits, not Medicaid. You’ll need either a Medicare Part D or Medicare Advantage plan with prescription drug coverage.

What is Included in MassHealth Dental?

Under federal regulations, kids with Massachusetts Medicaid will have access to most dental services. However, adults will only have access to cleanings, fillings, and x-rays. Advanced procedures like root canals and crowns are not covered for adults. Thankfully, there is a program in Massachusetts called “Health Safety Net.” MassHealth members who qualify for Health Safety Net can get free dental care. Qualifications for this program are based on the size of your medical bills, the type of health insurance that you currently have, and your Massachusetts residency. If you are accepted into the program, you’ll get free fillings, root canals, crowns, dentures, etc. according to your medical need.

MassHealth Transportation Benefit

Medicaid will cover ambulance services for individuals with a medical need. Uniquely, eligible beneficiaries can also get coverage for non-emergency transportation. This refers to taxi or accessible ran rides to and from doctors appointments. To be eligible, your doctor must complete a “prescription” for your transportation, certifying that you require assistance getting to and from your appointments. Some people with severe medical and financial needs may be able to get rides to and from a pharmacy as well. However, we recommend ordering your prescriptions online whenever possible, not just for ease but also to save time and money.

Therapy Coverage Details

Massachusetts Medicaid can cover medically necessary therapy services with some limitations. After 20 physical or occupational therapy visits (or 35 speech/language therapy visits), you’ll have to obtain authorization for more coverage. Your therapist can submit a request for prior authorization for you.

Out of State Coverage

If you are traveling outside of the state of Massachusetts and run into a medical emergency, don’t panic – you might be able to use your Medicaid coverage outside of Massachusetts. Show your MassHealth coverage card in whatever facility you find yourself in, and be sure to alert your primary physician back home that you received treatment elsewhere. Even if your out-of-state doctor is not able to accept your MassHealth card as insurance, you can file a claim for reimbursement when you get back home.

Plan Options

There are three types of Massachusetts Medicaid plans, and six variations of those plans. The three types are Accountable Care Organizations (ACOs), Managed Care Organizations (MCOs), and Primary Care Clinicians (PCCs). The main difference between the three types is the way in which the doctors are paid. The real difference for you will be between the six variations of Medicaid plans:

- Standard (what most people will have)

- CommonHealth

- Family Assistance

- Limited

- Senior Buy-In

- Buy-In

When your application is accepted, you will be automatically placed into the plan that makes the most sense for your income, citizenship, age, and circumstances.

Standard

The Standard plan is the most comprehensive and is the plan that most applicants will fall into. It covers:

- Hospital services

- Doctor and clinician services (including home health)

- Dental

- Lab tests and x-rays

- Physical, occupational, and speech-language therapy

- Eyeglasses and hearing aids

- Medical equipment and supplies

- Mental health and addiction services

- Hospice

- Medical transportation

- Long-term care and personal care attendant services

- Chronic disease rehabilitation

- Adult day care

- Organ transplant care (with prior authorization)

- Prescription drugs (except for those who also have Medicare)

- Coverage for Medicare Part A and B premiums, copayments, and deductibles except for prescriptions

CommonHealth

The CommonHealth program is similar to the Standard program but is exclusively for disabled people who do not qualify for the Standard program. You may need to pay a small monthly premium for the CommonHealth program. Benefits include everything that the Standard program covers.

Family Assistance

The Family Assistance program is a limited version of Massachusetts Medicaid for people who are not permanent U.S. citizens but are still in the country legally. Coverage is limited to:

- Hospital services

- Doctors and clinicians

- Dental, including dentures

- Lab tests and x-rays

- Medical equipment and supplies

- Physical, occupational, and speech-language therapy

- Mental health and addiction services

- Emergency-only transportation by ambulance

- Prescription drugs

Limited

The Limited program is basically a more limited version of the Family Assistance program. It is for those who are not permanent U.S. citizens but are in the country legally and are over the age of 65. Benefits are limited to:

- Emergency hospital services

- Limited doctor and clinician services

- Emergency pharmacy services

- Emergency-only transportation by ambulance

Buy-In/Senior Buy-In

The Massachusetts Medicaid Buy-In programs do not offer health benefits but provide financial coverage to those who need assistance paying for Medicare. The Senior Buy-In program is for those ages 65 and older who qualify based on income. It will cover Medicare Part A and B premiums, copayments, and deductibles, except for those relating to prescriptions. The other Buy-In program is for anyone below the age of 65 who has Medicare due to a disability. It can cover the Medicare Part B monthly premium.

Compare Plans from All Carriers in 1 Minute!

Massachusetts Medicaid Costs

Most people with Medicaid in Massachusetts will not have to pay very much at all for covered health services. Most drugs will only require a copayment of $1-4, and hospital stays will usually only cost $3. Those who are pregnant, under 21, or living in a care facility or hospice will usually not owe any copayments. Additionally, those in the “Limited” or “Buy-In” plans or are receiving services from the Indian Health Service will usually not face copays.

Masshealth Drug Coverage List

Emergency services, mental health services, inpatient hospital drugs, and family planning will never require a copayment. There is a copay max for every individual Massachusetts Medicaid member of $250 for drugs and $36 for hospital visits. That means that in any given year, once your costs hit those numbers, you will no longer owe any copayments for your covered services.

MassHealth Eligibility

To be eligible for Massachusetts Medicaid, you must be a Massachusetts resident, a verified citizen or legal alien, and financially eligible based on the number of people in your household and your “MAGI,” Modified Adjusted Gross Income. Not sure what your MAGI is? You can find it in your tax paperwork on line 37 of the 1040 form, line 21 of the 1040A form, or line four of the 1040EZ form.

MassHealth Application

You can apply for programs online by clicking here. To use this application, you must be under the age of 65 and not living in (or plan to be living in) a long-term care facility. Those in long-term care or over 65 should apply here instead.

For your application, you may need the following information for each household member who is applying:

- Your Social Security number

- Tax returns

- Citizenship status proof

- Proof of income/employer information

- Information about any other health insurance you have

If you would rather enroll in person, there are a handful of enrollment centers throughout the state that can help you. You should NOT send applications to these centers, but you can visit them in person for assistance. They are open Monday through Friday from 8:45 AM to 5 PM.

- 45 Spruce Street, Chelsea, MA 02150

- 88 Industry Ave., Suite D, Springfield, MA 01104

- 21 Spring St., Suite 4, Taunton, MA 02780

- 367 East Street, Tewksbury, MA 01876

- 100 Hancock Street, 6th floor, Quincy, MA 02171 (Central Office)

Get Both Medicare and Medicaid in Massachusetts

If you meet the Massachusetts Medicaid income requirements and also qualify for Massachusetts Medicare, you can benefit from both programs. For free help enrolling in a dual plan (for both Medicare and Medicaid), complete this brief form or give us a call at 833-438-7676.

Medicare coverage for nursing home care

Masshealth Copays

If a patient has spent 3 days in the hospital, Medicare may pay for care in a Skilled Nursing Facility:

Days 1 – 20: $ zero co pay for each benefit period

Days 21 - 100: patient pays $185.50 coinsurance per day during 2021

Days 101 and beyond: patient pays all costs

Do you know your rights to nursing home coverage under Medicare? Medicare Part A pays for inpatient hospital care, and then for care in a skilled nursing facility IF the patient has a 'qualified' hospital stay of at least 3 days (not counting day of discharge) before being admitted to the skilled nursing facility.

Medicare also pays for home health care, and the amount of reimbursement to home health care agencies also depends on whether the patient was admitted to a hospital before returning home. Patients who were put on Observation Status in the hospital end up paying out-of-pocket if they are discharged to a nursing home care:

Medicare is telling hospitals to keep patients 'under observation' to prevent eligibility for the 100 days of Skilled Nursing Facility benefits. A Medicare fact sheet warns patients to ask about their status when they are in the hospital: 'You’re an inpatient starting the day you’re formally admitted to the hospital with a doctor’s order. The day before you’re discharged is your last inpatient day.'Congress voted to require hospitals to tell Medicare patients when they are under observation care and have not been admitted to the hospital. The NOTICE law requires hospitals to provide written notification to patients 24 hours after receiving observation care, explaining that they have not been admitted to the hospital, the reasons why. The Notice must also disclose the financial implications for cost-sharing in the hospital and the patient's subsequent “eligibility for coverage” in a skilled nursing facility (SNF).

Medicare Advantage Discussion, Differences between Traditional Medicare and Medicare Advantage, 1 Page Factsheet, Caution on Medicare Advantage Plans

In a February 2, 2017 decision, the federal judge overseeing the Medicare 'Improvement Standard' case (Jimmo v. Burwell) ordered the Secretary of Health & Human Services to make it possible for nursing homes to comply with the Settlement, so discharged hospital patients can get rehabilitation. Many years after the Settlement was approved, the Center for Medicare Advocacy based in Willimantic, CT still hears from people who have been denied Medicare payment for home health, skilled nursing facility, and outpatient therapy. They advise Medicare beneficiaries and their families to continue citing the Jimmo Settlement materials linked on this page to challenge denials based on the old and erroneous “Improvement Standard.” Template Letter for Improvement Standard Appeal

If you go to the nursing home following a hospital stay, nursing homes are often reluctant to keep billing Medicare, because they think Medicare coverage depends on the beneficiary’s restoration potential; but the standard is whether skilled care is required:

Summary. Fact Sheet from Center for Medicare Advocacy. Even if full recovery or medical improvement is not possible, a patient may need skilled services to prevent further deterioration or preserve current capabilities. The nursing home patient who needs these skilled services should still be covered by Medicare.

Masshealth Copay Assistance

The February 16, 2017 statement by Centers for Medicare & Medicaid Services (CMS) says: 'Skilled nursing services would be covered where such skilled nursing services are necessary to maintain the patient's current condition or prevent or slow further deterioration so long as the beneficiary requires skilled care for the services to be safely and effectively provided.'

Masshealth Copays

'Skilled therapy services are covered when an individualized assessment of the patient's clinical condition demonstrates that the specialized judgment, knowledge, and skills of a qualified therapist ('skilled care') are necessary for the performance of a safe and effective maintenance program. Such a maintenance program to maintain the patient's current condition or to prevent or slow further deterioration is covered so long as the beneficiary requires skilled care for the safe and effective performance of the program.'

Hospital Observation Status can be financially devastating. Read More by Attorney John L. Roberts at: Agingcare.com 'This happened to us last year. After 4 days we were told the status was changing to outpatient.' More in Reader Comments.

Masshealth Copayment

Getting Medicare to pay for skilled nursing home care.

Next Page: Medication Management: Preventing Polypharmacy, Maximizing Medicare Part D, and Finding Alternative Payment Sources