PROPERTY TAX LAW DEADLINES

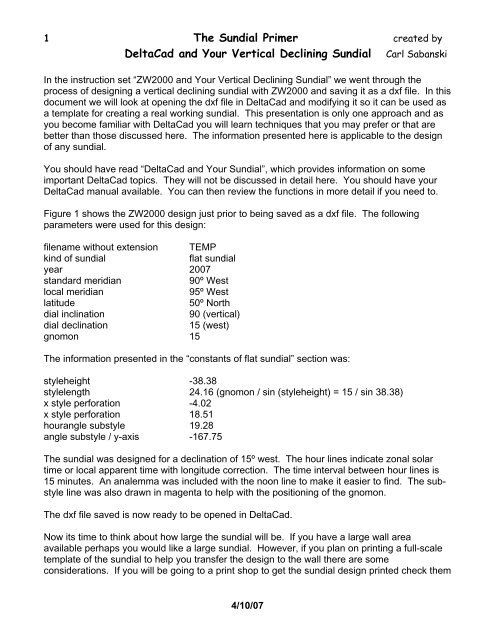

This calendar shows important property tax deadlines for appraisal districts, taxing units and property owners. Unless otherwise noted, all sections are Tax Code citations.

Tax Code Section 1.06 provides that “[i]f the last day for the performance of an act is a Saturday, Sunday, or legal state or national holiday, the act is timely if performed on the next regular business day.” The deadlines shown in this calendar reflect dates as they are provided in the law without any adjustment for an extension that might be applicable. Contact your local appraisal district or tax office if a due date falls on a weekend or holiday. To the extent that you need or want legal advice or seek an interpretation of statutory provisions, you should contact an attorney.

Deltacad offers everything I need to make quite complex engineering drawings. After using a variety of other CAD programs I have to say that Deltacad is the most. Deltacad offers everything I need to make quite complex engineering drawings. After using a variety of other CAD programs I have to say that Deltacad is the most usable, the most easily mastered and by far the best value.

This information is provided by the Texas Comptroller of Public Accounts as a public service and is intended to be used solely for informational purposes. The information neither constitutes nor serves as a substitute for legal advice. To obtain professional assurance regarding the issues addressed herein, the services of a competent professional should be sought.

Calendar

- Date that taxable values (except for inventories appraised Sept. 1) and qualification for certain exemptions are determined for the tax year (Secs. 11.42(a), 23.01(a), 23.12(f)).

- Date a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec. 32.01(a)).

- Date that members of county appraisal district (CAD) boards of directors begin two-year terms; half the members begin two-year terms if the CAD has staggered terms (Secs. 6.03(b), 6.034(a)and(e)).

- Date that half of appraisal review board (ARB) members begin two-year terms and that ARB commissioners begin one year terms (Sec. 6.41(d-8)).

- Date by which ARB commissioners, if appointed in the county, are required to return a list of proposed ARB members to the local administrative district judge (Sec. 6.41(d-7)).

- Deadline for chief appraisers to notify the Comptroller's office of eligibility to serve as chief appraisers (Sec. 6.05(c)).

- Date the temporary exemption for qualified property damaged by disaster expires as a qualified property of the first tax year in which the property is reappraised under Sec. 25.18 (Sec 11.35(k)).

- If a tax bill from the previous year is mailed after this date, the delinquency date is postponed (Sec. 31.04(a)).

- Deadline for the Comptroller's office to publish the preliminary Property Value Study (PVS) findings, certify findings to the Texas Education Commissioner, and deliver findings to each school district (Gov't Code Sec. 403.302(g))

NOTE: A qualified school district or property owner may protest preliminary findings by filing a petition with the Comptroller not later than the 40th day after the date (whether Jan. 31 or an earlier date) on which the Comptroller's findings are certified to the Texas Commissioner of Education (Gov't Code Sec.403.303(a)).

- Last day for chief appraiser to deliver applications for agricultural designation and exemptions requiring annual applications (Secs. 11.44(a)), 23.43(e)).

- Last day for disabled or age 65 or older homeowners or disabled veterans and their surviving spouses qualified for Sec. 11.22 exemptions to provide notice of intent to pay by installment and pay the first installment of homestead property taxes if the delinquency date is Feb. 1. Other delinquency dates have different installment notice and payment deadlines. This deadline also applies to partially disabled veterans and their surviving spouses with homesteads donated from charitable organizations (Sec. 31.031(a-1)).

- Last day for homeowners or qualified businesses whose properties were damaged in a disaster within a designated disaster area to pay the first installment for taxes with Feb. 1 delinquency dates if using installment payment option. Other delinquency dates have different notice and payment deadlines (Sec. 31.032(b)).

- Last day for a CAD to give public notice of the capitalization rate to be used in that year to appraise property with low- and moderate-income housing exemption (Sec. 11.1825(r)).

- Last day for motor vehicle, vessel and outboard motors, heavy equipment and manufactured housing dealers to file dealer's inventory declarations (Secs. 23.121(f), 23.124(f), 23.1241(f), 23.127(f)).

- Date that taxes imposed the previous year become delinquent if a bill was mailed on or before Jan. 10 of the current year (Secs. 31.02(a), 31.04(a)).

- Rollback tax and interest for change of use of 1-d, 1-d-1, timber, and restricted-use timber land become delinquent if taxing unit delivered a bill to the owner at least 20 days before this date (Secs. 23.46(c), 23.55(e), 23.76(e), 23.9807(f)).

- Deadline for chief appraisers in certain counties to provide notice regarding the availability of agreement forms authorizing electronic communication, on or before this date (or as soon as practicable) Sec. 1.085(h)).

- Last day for tax collector to disburse motor vehicle, vessel and outboard motor, heavy equipment and manufactured housing inventory taxes from escrow accounts to taxing units (Secs. 23.122(k), 23.1242(j), 23.125(k), 23.128(j)).

- Last day to request separate appraisal for interest in a cooperative housing corporation (Sec. 23.19(c)).

- Last day for taxing units' second quarterly payment for the current year CAD budget (Sec. 6.06(e)).

- Last day for disabled or age 65 or older homeowners or disabled veterans and their surviving spouses qualified for Sec. 11.22 exemptions to pay second installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines. This deadline also applies to partially disabled veterans and their surviving spouses with homesteads donated from charitable organizations (Sec. 31.031(a) and (a-1)).

- Last day for homeowners or qualified businesses whose properties were damaged in a disaster area to pay second installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines (Sec. 31.032(a) and (b)).

- Last day for qualified community housing development organizations to file listing of property acquired or sold during the past year with the chief appraiser (Sec. 11.182(i)).

- Last day for qualifying local governments to submit completed applications to the Comptroller's office to receive disabled veterans assistance payments for previous fiscal year (Local Gov't Code Sec. 140.011(e)).

- Last day (or as soon as practicable thereafter) for chief appraiser to mail notices of appraised value for single-family residence homestead properties (Sec. 25.19(a)).

- Last day (or as soon thereafter as practicable) for chief appraiser to deliver a clear and understandable written notice to property owner of a single-family residence that qualifies for an exemption under Sec. 11.13 if an exemption or partial exemption that was approved for the preceding year was canceled or reduced for the current year (Sec. 25.193(a)).

- Last day for the chief appraiser to notify the taxing units of the form in which the appraisal roll will be provided to them (Sec. 26.01(a)).

- Last day to file renditions and property reports on most property types. Chief appraiser must extend deadline to May 15 upon written request (Sec. 22.23(a) and (b)).

NOTE: The Comptroller and each chief appraiser are required to publicize the legal requirements for filing rendition statements and the availability of the forms in a manner reasonably designed to notify all property owners of the law (Sec. 22.21). Chief appraisers need to check with their legal counsel to determine the manner and timing of this notice to meet the legal requirement.

- Last day for property owners to file these applications or reports with the CAD:

- Some exemption applications (Sec. 11.43(d))*

- Notice to chief appraiser that property is no longer entitled to an exemption not requiring annual application (Sec. 11.43(g));

- Certain applications for special appraisal or notices to chief appraiser that property no longer qualifies for 1-d agricultural land, 1-d-1 agricultural land, timberland, restricted-use timberland, recreational-park-scenic land and public access airport property (Secs. 23.43(b), 23.54(d) and (h), 23.75(d) and (h), 23.84(b) and (d), 23.94(b) and (d), 23.9804(e) and (i));

- Railroad rolling stock reports (Sec. 24.32(e));

- Requests for separate listing of separately owned land and improvements (Sec. 25.08(c));

- Requests for proportionate taxing of a planned unit development association property (Sec. 25.09(b));

- Requests for separate listing of separately-owned standing timber and land (Sec. 25.10(c));

- Requests for separate listing of undivided interests (Sec. 25.11(b)); and

- Requests for joint taxation of separately owned mineral interests (Sec. 25.12(b)).

- Last day for chief appraiser to certify estimate of the taxable value for counties, municipalities, and school districts (counties and municipalities can choose to waive the estimate) (Sec. 26.01(e) and (f)). A school district with a fiscal year beginning July 1 may use this certified estimate when preparing the notices of public meetings to adopt the budget and discuss the proposed tax rate (Educ. Code Sec. 44.004(g)-(j)).

- Last day to file rendition statements and property reports for property regulated by the Texas Public Utility Commission, Texas Railroad Commission, federal Surface Transportation Board or the Federal Energy Regulatory Commission. Chief appraiser must extend deadline to May 15 upon written request (Sec. 22.23(d)).

- Last day for property owners to file applications for allocation under Secs. 21.03, 21.031, 21.05 or 21.055 for good cause. Chief appraiser shall extend deadline up to 30 days. Other deadlines apply if the property was not on the appraisal roll in the previous year. (Sec. 21.09(b)).

- Last day (or as soon as practicable thereafter) for chief appraiser to mail notices of appraised value for properties other than single-family residence homesteads (Sec. 25.19(a)).

- Last day (or as soon thereafter as practicable) for chief appraiser to deliver a clear and understandable written notice to the property owner of residence homestead property that does not qualify for an exemption under Sec. 11.13 if an exemption or partial exemption that was approved for the preceding year was canceled or reduced for the current year (Sec. 25.193(a)).

- Period to file resolutions with chief appraiser to change CAD finance method (Sec. 6.061(c)).

- Period when chief appraiser must publish notice about taxpayer protest procedures in a local newspaper with general circulation (Sec. 41.70(a) and (b)).

NOTE: Chief appraisers must annually publicize property owner rights and methods to protest to the ARB (Sec. 41.41(b)). Chief appraisers should consult legal counsel on the manner and timing to fulfill this requirement.

- Beginning of time period when taxing units must notify delinquent taxpayers that taxes delinquent on July 1 will incur additional penalty for attorney collection costs at least 30 days and not more than 60 days before July 1. Period ends on June 1 (Sec. 33.07(d)).

- Last day to file renditions and property reports for most property types if an extension was requested in writing. Chief appraiser may extend deadline an additional 15 days for good cause (Sec. 22.23(b)).

- Date (or as soon as practicable thereafter) for chief appraiser to prepare appraisal records and submit to ARB (Secs. 25.01(a), 25.22(a)).

- Last day to file most protests with ARB (or by 30th day after notice of appraised value is delivered, whichever is later) (Sec. 41.44(a)(1)).

- Last day for chief appraiser to determine whether a sufficient number of eligible taxing units filed resolutions to change CAD's finance method (Sec. 6.061(d)).

- Last day for chief appraiser to notify taxing units of change in the CAD's finance method (Sec. 6.061(d)).

- Last day for taxing units to file challenges with ARB (or within 15 days after the date the appraisal records are submitted to ARB (whichever is later) (Sec. 41.04).

- Last day for disabled or age 65 or older homeowners or disabled veterans and their surviving spouses qualified for Sec. 11.22 exemptions to pay third installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines. This deadline also applies to partially disabled veterans and their surviving spouses with homesteads donated from charitable organizations (Sec. 31.031(a) and (a-1)).

- Last day for homeowners and qualified businesses whose properties were damaged in a disaster area to pay third installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines (Sec. 31.032(a) and (b)).

- Last day for a religious organization that has been denied an 11.20 exemption because of its charter to amend the charter and file a new application (or before the 60th day after the date of notification of the exemption denial, whichever is later) (Sec. 11.421(b)).

- Last day for taxing unit to take official action to extend the date by which aircraft parts must be transported outside the state after acquired or imported to up to 730 days for the aircraft parts to be exempt from taxation as freeport goods for the current and subsequent tax years (Sec. 11.251(l)).

- Last day for chief appraiser to submit proposed budget for next year to CAD board and taxing units (unless taxing units have changed CAD's fiscal year) (Sec. 6.06(a) and (i)).

- Last day (or the 60th day after the date on which the chief appraiser delivers notice to the property owner under Sec 22.22, if applicable) for chief appraisers to accept and approve or deny late-filed freeport exemption applications (Sec. 11.4391(a)).

- Beginning date that CAD board may pass resolution to change CAD finance method, subject to taxing units' unanimous approval. Period ends before Aug. 15 (Sec. 6.061(a)).

- Last day to pay second half of split payment for taxes imposed last year (Sec. 31.03(a)).

- Last day for taxing units' third quarterly payment for CAD budget for the current year (Sec. 6.06(e)).

- Last day to form a taxing unit to levy property taxes for the current year (Sec. 26.12(d)).

- Last day for taxing units to adopt local option percentage homestead exemptions (Sec. 11.13(n)).

- Last day for a private school that has been denied an 11.21 exemption because of the charter to amend the charter and file a new application (or the 60th day after the date of notification of the exemption denial, whichever is later) (Sec. 11.422(a)(1)).

- Date that delinquent taxes incur total 12 percent penalty (Sec. 33.01(a)).

- A taxing unit or CAD may provide that taxes that become delinquent on or after Feb. 1 of a year but not later than May 1 of that year and that remain delinquent on July 1 of the year in which they become delinquent incur an additional penalty to defray costs of collection, if the unit or CAD or another unit that collects taxes for the unit has contracted with an attorney to enforce the collection of delinquent taxes (Sec. 33.07(a)).

NOTE: Taxing units and CADs that have imposed the additional penalty for collection costs under Sec. 33.07 may provide for an additional penalty for attorney collection costs of taxes that become delinquent on or after June 1 under Secs. 26.07(f), 26.15(e), 31.03, 31.031, 31.032, 31.04, or 42.42. The penalty is incurred on the first day of the first month that begins at least 21 days after the date the collector sends the property owner a notice of delinquency and penalty (Sec 33.08(a) and (c)).

- Last day for review and protests of appraisals of railroad rolling stock values (or as soon as practicable thereafter); once the appraised value is approved, the chief appraiser certifies to the Comptroller's office the allocated market value (Secs. 24.35(b), 24.36).

- Date ARB must approve appraisal records, but may not do so if more than 5 percent of total appraised value remains under protest. The board of directors of a CAD in a county with a population of 1 million or more may postpone the deadline to Aug. 30 or increase the threshold percentage from 5 to 10 percent of the appraised value of properties not under protest (Sec. 41.12(a)-(c)).

- Last day for Comptroller's office to certify apportionment of railroad rolling stock value to counties, with supplemental records after that date (Secs. 24.38, 24.40).

- Last day for chief appraiser to certify appraisal roll to each taxing unit (Sec. 26.01(a)).

- Last day for chief appraiser to prepare and certify to the assessor for each taxing unit an estimate of the taxable value of the property if the ARB has not approved the appraisal records by July 20 (Sec. 26.01(a-1)).

- Last day for disabled or age 65 or older homeowners or disabled veterans and their surviving spouses qualified for Sec. 11.22 to pay fourth installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines. This deadline also applies to partially disabled veterans and their surviving spouses with homesteads donated from charitable organizations (Sec. 31.031(a-1)).

- Last day for homeowners and qualified businesses whose properties were damaged in a disaster area to pay fourth installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines (Sec. 31.032(b)).

- Last day for property owners to apply for Sept. 1 inventory appraisal for the next year (Sec. 23.12(f)).

- Date taxing unit's assessor submits appraisal roll and date that collector submits collection rate estimate for the current year to the governing body (or soon after as practical) (Sec. 26.04(b)).

- Date taxing units (other than school districts, small taxing units and water districts) must publicize no-new-revenue and voter-approval tax rates, unencumbered fund balances, debt obligation schedule and other applicable items (or as soon as practical thereafter) (Secs. 26.04(e) and (e)(1), 26.052(b) and Water Code Secs. 49.107(g), 49.108(f)).

- Last day for CAD board to pass resolution to change CAD finance method, subject to taxing unit's unanimous consent (Sec. 6.061(a)).

- Last day for CAD board to pass resolution to change number of directors, method for appointing, or both, and deliver the resolution to each taxing unit (Sec. 6.031(a)).

- Deadline for Comptroller's office to certify final PVS findings to Education Commissioner except as provided (Comptroller Rule Sec. 9.4317(d)).

- Date ARB must approve appraisal records for CADs in counties with populations of 1 million or more where the board of directors has postponed the deadline from July 20 (Sec. 41.12(c)(1)).

- If a tax bill is returned undelivered to a taxing unit by the United States Postal Service, a taxing unit must waive penalties and interest if the taxing unit does not send another tax bill at least 21 days before the delinquency date to the current mailing address furnished by the property owner and the property owner establishes that a current mailing address was furnished to the CAD for the tax bill before Sept. 1 of the year in which the tax is assessed (Sec. 33.011(b)(1)).

- Last day taxing units may file resolutions with the CAD board to oppose proposed change in the CAD finance method (Sec. 6.061(a)).

- Last day for taxing unit entitled to vote for appointment of CAD directors to file a resolution opposing a change by the CAD board in the number and selection of directors (Sec. 6.031(a)).

- Deadline to file form with chief appraiser and collector to elect not to be treated as a motor vehicle inventory dealer for the next tax year, if eligible (Sec. 23.121(a)(3)(D)(iii)).

- Date that taxable value of inventories may be determined at property owner's written option (Sec. 23.12(f)).

- Last day for CAD board to adopt CAD budget for the next year, unless a district has changed its fiscal year (Sec. 6.06(b) and (i)).

- Last day for CAD board to notify taxing units in writing if a proposal to change a finance method by taxing units' unanimous consent has been rejected (Sec. 6.061(a)).

- Last day for CAD board to notify taxing units in writing if a proposal to change the number or method of selecting CAD directors is rejected by a voting taxing unit (Sec. 6.031(a)).

- Last day for taxing units to adopt tax rate for the current year, or before the 60th day after the date the certified appraisal roll is received by a taxing unit, whichever is later. Failure to adopt by these required dates results in a unit adopting the lower of its no-new-revenue tax rate for this year or last year's tax rate; unit's governing body must ratify new rate within five days of establishing rate (Sec. 26.05(a) and(c)).

- Last day for taxing units' fourth quarterly payment for CAD budget for the current year (Sec. 6.06(e)).

- Date tax assessor mails tax bills for the year (or soon after as practical) (Sec. 31.01(a)).

- First half of split payment of taxes is due on or before this date (Sec 31.03(a)).

- Time when appraisal office may conduct a mail survey to verify homestead exemption eligibility (Sec. 11.47(a)).

- Last day for taxing units' first quarterly payment for CAD budget for next year (Sec. 6.06(e)).

- Last day for taxing units to take official action to tax goods-in-transit for the following tax year (Sec. 11.253(j)).

PROPERTY TAX LAW DEADLINES

This calendar shows important property tax deadlines for appraisal districts, taxing units and property owners. Unless otherwise noted, all sections are Tax Code citations.

Tax Code Section 1.06 provides that “[i]f the last day for the performance of an act is a Saturday, Sunday, or legal state or national holiday, the act is timely if performed on the next regular business day.” The deadlines shown in this calendar reflect dates as they are provided in the law without any adjustment for an extension that might be applicable. Contact your local appraisal district or tax office if a due date falls on a weekend or holiday. To the extent that you need or want legal advice or seek an interpretation of statutory provisions, you should contact an attorney.

This information is provided by the Texas Comptroller of Public Accounts as a public service and is intended to be used solely for informational purposes. The information neither constitutes nor serves as a substitute for legal advice. To obtain professional assurance regarding the issues addressed herein, the services of a competent professional should be sought.

Calendar

- Date that taxable values (except for inventories appraised Sept. 1) and qualification for certain exemptions are determined for the tax year (Secs. 11.42(a), 23.01(a), 23.12(f)).

- Date a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec. 32.01(a)).

- Date that members of county appraisal district (CAD) boards of directors begin two-year terms; half the members begin two-year terms if the CAD has staggered terms (Secs. 6.03(b), 6.034(a)and(e)).

- Date that half of appraisal review board (ARB) members begin two-year terms and that ARB commissioners begin one year terms (Sec. 6.41(d-8)).

- Date by which ARB commissioners, if appointed in the county, are required to return a list of proposed ARB members to the local administrative district judge (Sec. 6.41(d-7)).

- Deadline for chief appraisers to notify the Comptroller's office of eligibility to serve as chief appraisers (Sec. 6.05(c)).

- Date the temporary exemption for qualified property damaged by disaster expires as a qualified property of the first tax year in which the property is reappraised under Sec. 25.18 (Sec 11.35(k)).

- If a tax bill from the previous year is mailed after this date, the delinquency date is postponed (Sec. 31.04(a)).

- Deadline for the Comptroller's office to publish the preliminary Property Value Study (PVS) findings, certify findings to the Texas Education Commissioner, and deliver findings to each school district (Gov't Code Sec. 403.302(g))

NOTE: A qualified school district or property owner may protest preliminary findings by filing a petition with the Comptroller not later than the 40th day after the date (whether Jan. 31 or an earlier date) on which the Comptroller's findings are certified to the Texas Commissioner of Education (Gov't Code Sec.403.303(a)).

- Last day for chief appraiser to deliver applications for agricultural designation and exemptions requiring annual applications (Secs. 11.44(a)), 23.43(e)).

- Last day for disabled or age 65 or older homeowners or disabled veterans and their surviving spouses qualified for Sec. 11.22 exemptions to provide notice of intent to pay by installment and pay the first installment of homestead property taxes if the delinquency date is Feb. 1. Other delinquency dates have different installment notice and payment deadlines. This deadline also applies to partially disabled veterans and their surviving spouses with homesteads donated from charitable organizations (Sec. 31.031(a-1)).

- Last day for homeowners or qualified businesses whose properties were damaged in a disaster within a designated disaster area to pay the first installment for taxes with Feb. 1 delinquency dates if using installment payment option. Other delinquency dates have different notice and payment deadlines (Sec. 31.032(b)).

- Last day for a CAD to give public notice of the capitalization rate to be used in that year to appraise property with low- and moderate-income housing exemption (Sec. 11.1825(r)).

- Last day for motor vehicle, vessel and outboard motors, heavy equipment and manufactured housing dealers to file dealer's inventory declarations (Secs. 23.121(f), 23.124(f), 23.1241(f), 23.127(f)).

- Date that taxes imposed the previous year become delinquent if a bill was mailed on or before Jan. 10 of the current year (Secs. 31.02(a), 31.04(a)).

- Rollback tax and interest for change of use of 1-d, 1-d-1, timber, and restricted-use timber land become delinquent if taxing unit delivered a bill to the owner at least 20 days before this date (Secs. 23.46(c), 23.55(e), 23.76(e), 23.9807(f)).

- Deadline for chief appraisers in certain counties to provide notice regarding the availability of agreement forms authorizing electronic communication, on or before this date (or as soon as practicable) Sec. 1.085(h)).

- Last day for tax collector to disburse motor vehicle, vessel and outboard motor, heavy equipment and manufactured housing inventory taxes from escrow accounts to taxing units (Secs. 23.122(k), 23.1242(j), 23.125(k), 23.128(j)).

- Last day to request separate appraisal for interest in a cooperative housing corporation (Sec. 23.19(c)).

- Last day for taxing units' second quarterly payment for the current year CAD budget (Sec. 6.06(e)).

- Last day for disabled or age 65 or older homeowners or disabled veterans and their surviving spouses qualified for Sec. 11.22 exemptions to pay second installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines. This deadline also applies to partially disabled veterans and their surviving spouses with homesteads donated from charitable organizations (Sec. 31.031(a) and (a-1)).

- Last day for homeowners or qualified businesses whose properties were damaged in a disaster area to pay second installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines (Sec. 31.032(a) and (b)).

- Last day for qualified community housing development organizations to file listing of property acquired or sold during the past year with the chief appraiser (Sec. 11.182(i)).

- Last day for qualifying local governments to submit completed applications to the Comptroller's office to receive disabled veterans assistance payments for previous fiscal year (Local Gov't Code Sec. 140.011(e)).

- Last day (or as soon as practicable thereafter) for chief appraiser to mail notices of appraised value for single-family residence homestead properties (Sec. 25.19(a)).

- Last day (or as soon thereafter as practicable) for chief appraiser to deliver a clear and understandable written notice to property owner of a single-family residence that qualifies for an exemption under Sec. 11.13 if an exemption or partial exemption that was approved for the preceding year was canceled or reduced for the current year (Sec. 25.193(a)).

- Last day for the chief appraiser to notify the taxing units of the form in which the appraisal roll will be provided to them (Sec. 26.01(a)).

- Last day to file renditions and property reports on most property types. Chief appraiser must extend deadline to May 15 upon written request (Sec. 22.23(a) and (b)).

NOTE: The Comptroller and each chief appraiser are required to publicize the legal requirements for filing rendition statements and the availability of the forms in a manner reasonably designed to notify all property owners of the law (Sec. 22.21). Chief appraisers need to check with their legal counsel to determine the manner and timing of this notice to meet the legal requirement.

- Last day for property owners to file these applications or reports with the CAD:

- Some exemption applications (Sec. 11.43(d))*

- Notice to chief appraiser that property is no longer entitled to an exemption not requiring annual application (Sec. 11.43(g));

- Certain applications for special appraisal or notices to chief appraiser that property no longer qualifies for 1-d agricultural land, 1-d-1 agricultural land, timberland, restricted-use timberland, recreational-park-scenic land and public access airport property (Secs. 23.43(b), 23.54(d) and (h), 23.75(d) and (h), 23.84(b) and (d), 23.94(b) and (d), 23.9804(e) and (i));

- Railroad rolling stock reports (Sec. 24.32(e));

- Requests for separate listing of separately owned land and improvements (Sec. 25.08(c));

- Requests for proportionate taxing of a planned unit development association property (Sec. 25.09(b));

- Requests for separate listing of separately-owned standing timber and land (Sec. 25.10(c));

- Requests for separate listing of undivided interests (Sec. 25.11(b)); and

- Requests for joint taxation of separately owned mineral interests (Sec. 25.12(b)).

- Last day for chief appraiser to certify estimate of the taxable value for counties, municipalities, and school districts (counties and municipalities can choose to waive the estimate) (Sec. 26.01(e) and (f)). A school district with a fiscal year beginning July 1 may use this certified estimate when preparing the notices of public meetings to adopt the budget and discuss the proposed tax rate (Educ. Code Sec. 44.004(g)-(j)).

- Last day to file rendition statements and property reports for property regulated by the Texas Public Utility Commission, Texas Railroad Commission, federal Surface Transportation Board or the Federal Energy Regulatory Commission. Chief appraiser must extend deadline to May 15 upon written request (Sec. 22.23(d)).

- Last day for property owners to file applications for allocation under Secs. 21.03, 21.031, 21.05 or 21.055 for good cause. Chief appraiser shall extend deadline up to 30 days. Other deadlines apply if the property was not on the appraisal roll in the previous year. (Sec. 21.09(b)).

- Last day (or as soon as practicable thereafter) for chief appraiser to mail notices of appraised value for properties other than single-family residence homesteads (Sec. 25.19(a)).

- Last day (or as soon thereafter as practicable) for chief appraiser to deliver a clear and understandable written notice to the property owner of residence homestead property that does not qualify for an exemption under Sec. 11.13 if an exemption or partial exemption that was approved for the preceding year was canceled or reduced for the current year (Sec. 25.193(a)).

Deltacad Windows 10

- Period to file resolutions with chief appraiser to change CAD finance method (Sec. 6.061(c)).

- Period when chief appraiser must publish notice about taxpayer protest procedures in a local newspaper with general circulation (Sec. 41.70(a) and (b)).

NOTE: Chief appraisers must annually publicize property owner rights and methods to protest to the ARB (Sec. 41.41(b)). Chief appraisers should consult legal counsel on the manner and timing to fulfill this requirement.

Deltacadd

- Beginning of time period when taxing units must notify delinquent taxpayers that taxes delinquent on July 1 will incur additional penalty for attorney collection costs at least 30 days and not more than 60 days before July 1. Period ends on June 1 (Sec. 33.07(d)).

- Last day to file renditions and property reports for most property types if an extension was requested in writing. Chief appraiser may extend deadline an additional 15 days for good cause (Sec. 22.23(b)).

- Date (or as soon as practicable thereafter) for chief appraiser to prepare appraisal records and submit to ARB (Secs. 25.01(a), 25.22(a)).

- Last day to file most protests with ARB (or by 30th day after notice of appraised value is delivered, whichever is later) (Sec. 41.44(a)(1)).

- Last day for chief appraiser to determine whether a sufficient number of eligible taxing units filed resolutions to change CAD's finance method (Sec. 6.061(d)).

- Last day for chief appraiser to notify taxing units of change in the CAD's finance method (Sec. 6.061(d)).

- Last day for taxing units to file challenges with ARB (or within 15 days after the date the appraisal records are submitted to ARB (whichever is later) (Sec. 41.04).

- Last day for disabled or age 65 or older homeowners or disabled veterans and their surviving spouses qualified for Sec. 11.22 exemptions to pay third installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines. This deadline also applies to partially disabled veterans and their surviving spouses with homesteads donated from charitable organizations (Sec. 31.031(a) and (a-1)).

- Last day for homeowners and qualified businesses whose properties were damaged in a disaster area to pay third installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines (Sec. 31.032(a) and (b)).

- Last day for a religious organization that has been denied an 11.20 exemption because of its charter to amend the charter and file a new application (or before the 60th day after the date of notification of the exemption denial, whichever is later) (Sec. 11.421(b)).

- Last day for taxing unit to take official action to extend the date by which aircraft parts must be transported outside the state after acquired or imported to up to 730 days for the aircraft parts to be exempt from taxation as freeport goods for the current and subsequent tax years (Sec. 11.251(l)).

- Last day for chief appraiser to submit proposed budget for next year to CAD board and taxing units (unless taxing units have changed CAD's fiscal year) (Sec. 6.06(a) and (i)).

- Last day (or the 60th day after the date on which the chief appraiser delivers notice to the property owner under Sec 22.22, if applicable) for chief appraisers to accept and approve or deny late-filed freeport exemption applications (Sec. 11.4391(a)).

- Beginning date that CAD board may pass resolution to change CAD finance method, subject to taxing units' unanimous approval. Period ends before Aug. 15 (Sec. 6.061(a)).

- Last day to pay second half of split payment for taxes imposed last year (Sec. 31.03(a)).

- Last day for taxing units' third quarterly payment for CAD budget for the current year (Sec. 6.06(e)).

- Last day to form a taxing unit to levy property taxes for the current year (Sec. 26.12(d)).

- Last day for taxing units to adopt local option percentage homestead exemptions (Sec. 11.13(n)).

- Last day for a private school that has been denied an 11.21 exemption because of the charter to amend the charter and file a new application (or the 60th day after the date of notification of the exemption denial, whichever is later) (Sec. 11.422(a)(1)).

- Date that delinquent taxes incur total 12 percent penalty (Sec. 33.01(a)).

- A taxing unit or CAD may provide that taxes that become delinquent on or after Feb. 1 of a year but not later than May 1 of that year and that remain delinquent on July 1 of the year in which they become delinquent incur an additional penalty to defray costs of collection, if the unit or CAD or another unit that collects taxes for the unit has contracted with an attorney to enforce the collection of delinquent taxes (Sec. 33.07(a)).

NOTE: Taxing units and CADs that have imposed the additional penalty for collection costs under Sec. 33.07 may provide for an additional penalty for attorney collection costs of taxes that become delinquent on or after June 1 under Secs. 26.07(f), 26.15(e), 31.03, 31.031, 31.032, 31.04, or 42.42. The penalty is incurred on the first day of the first month that begins at least 21 days after the date the collector sends the property owner a notice of delinquency and penalty (Sec 33.08(a) and (c)).

- Last day for review and protests of appraisals of railroad rolling stock values (or as soon as practicable thereafter); once the appraised value is approved, the chief appraiser certifies to the Comptroller's office the allocated market value (Secs. 24.35(b), 24.36).

- Date ARB must approve appraisal records, but may not do so if more than 5 percent of total appraised value remains under protest. The board of directors of a CAD in a county with a population of 1 million or more may postpone the deadline to Aug. 30 or increase the threshold percentage from 5 to 10 percent of the appraised value of properties not under protest (Sec. 41.12(a)-(c)).

- Last day for Comptroller's office to certify apportionment of railroad rolling stock value to counties, with supplemental records after that date (Secs. 24.38, 24.40).

- Last day for chief appraiser to certify appraisal roll to each taxing unit (Sec. 26.01(a)).

- Last day for chief appraiser to prepare and certify to the assessor for each taxing unit an estimate of the taxable value of the property if the ARB has not approved the appraisal records by July 20 (Sec. 26.01(a-1)).

- Last day for disabled or age 65 or older homeowners or disabled veterans and their surviving spouses qualified for Sec. 11.22 to pay fourth installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines. This deadline also applies to partially disabled veterans and their surviving spouses with homesteads donated from charitable organizations (Sec. 31.031(a-1)).

- Last day for homeowners and qualified businesses whose properties were damaged in a disaster area to pay fourth installment on taxes with Feb. 1 delinquency dates. Other delinquency dates have different installment payment deadlines (Sec. 31.032(b)).

- Last day for property owners to apply for Sept. 1 inventory appraisal for the next year (Sec. 23.12(f)).

- Date taxing unit's assessor submits appraisal roll and date that collector submits collection rate estimate for the current year to the governing body (or soon after as practical) (Sec. 26.04(b)).

- Date taxing units (other than school districts, small taxing units and water districts) must publicize no-new-revenue and voter-approval tax rates, unencumbered fund balances, debt obligation schedule and other applicable items (or as soon as practical thereafter) (Secs. 26.04(e) and (e)(1), 26.052(b) and Water Code Secs. 49.107(g), 49.108(f)).

- Last day for CAD board to pass resolution to change CAD finance method, subject to taxing unit's unanimous consent (Sec. 6.061(a)).

- Last day for CAD board to pass resolution to change number of directors, method for appointing, or both, and deliver the resolution to each taxing unit (Sec. 6.031(a)).

- Deadline for Comptroller's office to certify final PVS findings to Education Commissioner except as provided (Comptroller Rule Sec. 9.4317(d)).

Deltacad Pro

- Date ARB must approve appraisal records for CADs in counties with populations of 1 million or more where the board of directors has postponed the deadline from July 20 (Sec. 41.12(c)(1)).

- If a tax bill is returned undelivered to a taxing unit by the United States Postal Service, a taxing unit must waive penalties and interest if the taxing unit does not send another tax bill at least 21 days before the delinquency date to the current mailing address furnished by the property owner and the property owner establishes that a current mailing address was furnished to the CAD for the tax bill before Sept. 1 of the year in which the tax is assessed (Sec. 33.011(b)(1)).

- Last day taxing units may file resolutions with the CAD board to oppose proposed change in the CAD finance method (Sec. 6.061(a)).

- Last day for taxing unit entitled to vote for appointment of CAD directors to file a resolution opposing a change by the CAD board in the number and selection of directors (Sec. 6.031(a)).

- Deadline to file form with chief appraiser and collector to elect not to be treated as a motor vehicle inventory dealer for the next tax year, if eligible (Sec. 23.121(a)(3)(D)(iii)).

Deltacad Forum

- Date that taxable value of inventories may be determined at property owner's written option (Sec. 23.12(f)).

- Last day for CAD board to adopt CAD budget for the next year, unless a district has changed its fiscal year (Sec. 6.06(b) and (i)).

- Last day for CAD board to notify taxing units in writing if a proposal to change a finance method by taxing units' unanimous consent has been rejected (Sec. 6.061(a)).

- Last day for CAD board to notify taxing units in writing if a proposal to change the number or method of selecting CAD directors is rejected by a voting taxing unit (Sec. 6.031(a)).

Deltacad Review

- Last day for taxing units to adopt tax rate for the current year, or before the 60th day after the date the certified appraisal roll is received by a taxing unit, whichever is later. Failure to adopt by these required dates results in a unit adopting the lower of its no-new-revenue tax rate for this year or last year's tax rate; unit's governing body must ratify new rate within five days of establishing rate (Sec. 26.05(a) and(c)).

- Last day for taxing units' fourth quarterly payment for CAD budget for the current year (Sec. 6.06(e)).

- Date tax assessor mails tax bills for the year (or soon after as practical) (Sec. 31.01(a)).

- First half of split payment of taxes is due on or before this date (Sec 31.03(a)).

Deltacad Manual

- Time when appraisal office may conduct a mail survey to verify homestead exemption eligibility (Sec. 11.47(a)).

- Last day for taxing units' first quarterly payment for CAD budget for next year (Sec. 6.06(e)).

- Last day for taxing units to take official action to tax goods-in-transit for the following tax year (Sec. 11.253(j)).